This is the 100th post of the year! Time for a review? Not yet, I will wait until the end of the year. There are still two months to go, one of them with some tennis highlights. Especially for Switzerland and Roger Federer will come interesting weeks. Can he be the oldest number 1 ever? Will Switzerland win the Davis Cup for the first time?

In the last weeks of the tennis year I will work on the strategies. There are still some issues with a bad risk-/reward ratio I have to figure out. Lately I started to accept losing trades. I stopped to hope for a turnaround. The word "hope" doesn't exist anymore in my trading vocabulary. In the book "trading in the zone" was mentioned the fear of losing a trade. In the past I often lost more than I should because I was afraid to exit with a negative result. Now I can close a trade (normally after the first set), and I am not interested anymore in the final outcome of the tennis match. At least not, when there is not a new trading opportunity.

I am still searching for the edge. I think this is the hardest part to become a professional trader. Sultan changed his strategies, and after a while he became successful. I tried his approach, but it didn't work for me. Probably his (biggest) edge is the good feeling for tennis matches. I am looking for a strategy where I can trade more the charts (market) than the players. In the end it's probably a mix of both. The game selection should be part of the trades, but in general the strategy should work without a "crystal ball". If the hit rate is "only" based on a good selection of the games, the variance can be huge. The best tipsters have bad runs and latest with the premium charge, a system without a real edge will not work anymore. The best tipster can't beat a 60% disadvantage...

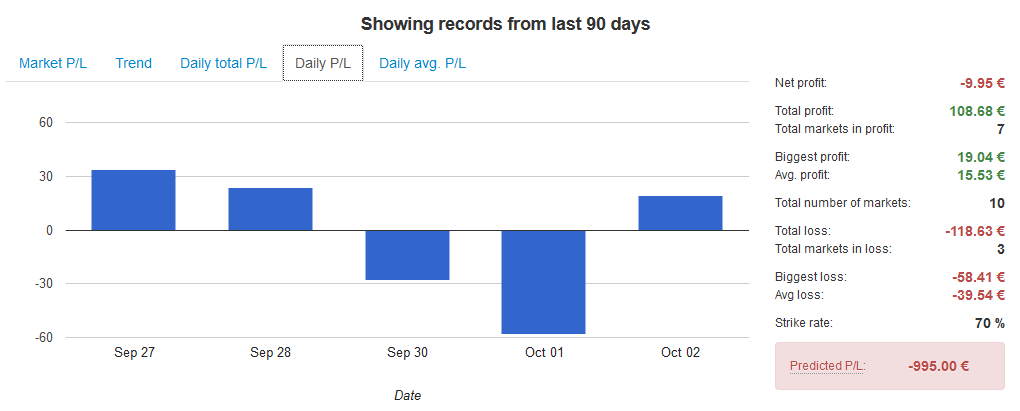

Until the strategies are stable, I will not document my trades at mybetlog.com. The following weeks are good to make a fine tuning of the approach. At this stage I can trade with small amounts. The crucial point is the risk-/reward-ratio. If a hit rate of 30-40% it's enough to make profit, the pressure is a lot smaller than with a need of 80%. At this point I am working at the moment.

In the last weeks of the tennis year I will work on the strategies. There are still some issues with a bad risk-/reward ratio I have to figure out. Lately I started to accept losing trades. I stopped to hope for a turnaround. The word "hope" doesn't exist anymore in my trading vocabulary. In the book "trading in the zone" was mentioned the fear of losing a trade. In the past I often lost more than I should because I was afraid to exit with a negative result. Now I can close a trade (normally after the first set), and I am not interested anymore in the final outcome of the tennis match. At least not, when there is not a new trading opportunity.

I am still searching for the edge. I think this is the hardest part to become a professional trader. Sultan changed his strategies, and after a while he became successful. I tried his approach, but it didn't work for me. Probably his (biggest) edge is the good feeling for tennis matches. I am looking for a strategy where I can trade more the charts (market) than the players. In the end it's probably a mix of both. The game selection should be part of the trades, but in general the strategy should work without a "crystal ball". If the hit rate is "only" based on a good selection of the games, the variance can be huge. The best tipsters have bad runs and latest with the premium charge, a system without a real edge will not work anymore. The best tipster can't beat a 60% disadvantage...

Until the strategies are stable, I will not document my trades at mybetlog.com. The following weeks are good to make a fine tuning of the approach. At this stage I can trade with small amounts. The crucial point is the risk-/reward-ratio. If a hit rate of 30-40% it's enough to make profit, the pressure is a lot smaller than with a need of 80%. At this point I am working at the moment.