2014 was definitely not my best year. Fortunately nobody beloved died or became serious ill, but beside it was one of the most disappointing years in my life.

I am sure that 2015 will be a better year. I made some decicisions after the disappointing 2014. Sultan asked me a year ago why I want to be a trader with my income. I told him that I like more liberty and that I love trading. After one year I know that the price for this liberty is (too) high. If you work 50% as a normal employee, you are neither fish nor bird. My salary was inadequate and the tasks were boring. With my background I should work on management level and not as a gofer. Beside I couldn't trade as much as I wanted. Often I missed the best matches. I was impatient during the times I was trading, because I had not the time and skills like a professional. In general trading is stress, you don't have paid holidays, pension fund and you never know if you win or lose. Latest with the premium charge I wouldn't have any chance to earn what I can with a normal job.

I bought a new appartement. At the end of the year 2015 it should be finished. It gives me motivation to know that I will live again at a nice place. Even a comeback with my wife seems possible. I recognized that a relationship is hard work and probably I gave it up too early. During the desastrous year I recognized who is on my side and who is against me.

Well to come to an end of this post... I decided to stop trading as a profession. I will return to a normal job which has more advantages I thought one year ago. A lot of traders have not my possibilities on the job market. So it would be a waste of (not earned) money and time to continue with trading. Cassini works beside and is successful on the sportsmarket. I try to go on his path.

I will keep the blog, but the target is not anymore to become a professional trader. I just do it for fun and without any stress. I expect to start a new job at the beginning of April or May. So I can start the tennis season still as part time trader, but with less pressure.

- First of all I was scammed. I lost almost 60'000 Euros... It's still very difficult to understand how people (with a normal life) can do this. I learned that you can't trust (almost) nobody in sportstrading. It's a lonely business, and everybody is looking for the own advantage.

- After I sold my appartment I lived for a while with a guy (no I am not gay, was just to reduce the costs :-)). Without a reason he finished the contract by email! Really a strange guy, he is not working and sits the whole day in front of the TV. I think he lives from the social system of Switzerland. In the end I was happy to not living anymore with him, but beside the scammer he was the second big disappointment.

- I changed the job in the beginning of the year. I worked part time as a CFO in a small company. The main reason for this change was my planned trading career. I wanted to have time for it. The company started the year with 17 people. More than the half of them quitted or were fired. The enterprise is in financial troubles and I don't expect a turnaround.

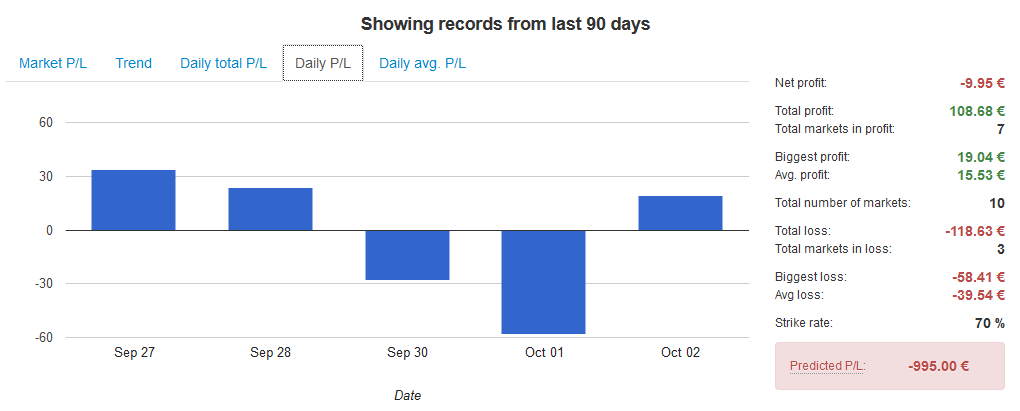

- Trading was not succesful. Mistakes, impatience and bad money moneymanagament led to a five digit loss over the year.

I am sure that 2015 will be a better year. I made some decicisions after the disappointing 2014. Sultan asked me a year ago why I want to be a trader with my income. I told him that I like more liberty and that I love trading. After one year I know that the price for this liberty is (too) high. If you work 50% as a normal employee, you are neither fish nor bird. My salary was inadequate and the tasks were boring. With my background I should work on management level and not as a gofer. Beside I couldn't trade as much as I wanted. Often I missed the best matches. I was impatient during the times I was trading, because I had not the time and skills like a professional. In general trading is stress, you don't have paid holidays, pension fund and you never know if you win or lose. Latest with the premium charge I wouldn't have any chance to earn what I can with a normal job.

I bought a new appartement. At the end of the year 2015 it should be finished. It gives me motivation to know that I will live again at a nice place. Even a comeback with my wife seems possible. I recognized that a relationship is hard work and probably I gave it up too early. During the desastrous year I recognized who is on my side and who is against me.

Well to come to an end of this post... I decided to stop trading as a profession. I will return to a normal job which has more advantages I thought one year ago. A lot of traders have not my possibilities on the job market. So it would be a waste of (not earned) money and time to continue with trading. Cassini works beside and is successful on the sportsmarket. I try to go on his path.

I will keep the blog, but the target is not anymore to become a professional trader. I just do it for fun and without any stress. I expect to start a new job at the beginning of April or May. So I can start the tennis season still as part time trader, but with less pressure.